39+ mortgage interest deduction limitation

If one or more of your. Web 52 minutes ago2.

Maximum Mortgage Tax Deduction Benefit Depends On Income

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Another itemized deduction is the SALT deduction which. Web Heres whats happening.

But claiming a deduction you arent. Web Yes of course. Under Tax Cut and Jobs Act for tax years beginning after December 31 2017 and before January 1 2026 a taxpayer may not deduct home.

Web For homes acquired after December 15 2017 the debt limitation is 750000 or 375000 if youre married filing separately. Apply Online Get Pre-Approved Today. 750000 if the loan was finalized.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million.

Make sure youre claiming the right deductions. You may be eager to take advantage of all of the tax benefits you can. Homeowners who bought houses before.

Lets start with the mortgage from 2016 with an average balance of. Discover Helpful Information And Resources On Taxes From AARP. That means that the mortgage interest you.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Here is a simplified example with two instead of three mortgages. Web For the 2020 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage.

Ad Compare Best Mortgage Lenders 2023.

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The New Home Mortgage Interest Deduction Mark J Kohler

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Vacation Home Rentals And The Tcja Journal Of Accountancy

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Faqs Jeremy Kisner

New Mortgage Interest Deduction Rules Evergreen Small Business

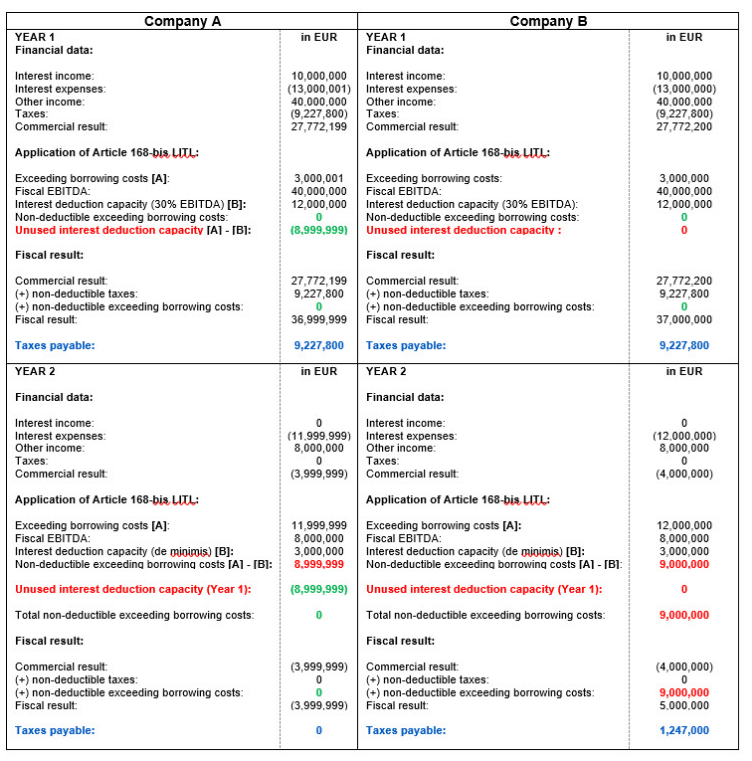

Luxembourg Interest Deduction Limitation Rule New Guidance Released By The Luxembourg Tax Authorities

What Is Debts In Finance Quora

Mortgage Interest Deduction Is Limited To Interest Paid During The Year Shindelrock

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

What Is The Mortgage Interest Deduction The Motley Fool

![]()

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube